Join Date: Feb 2011

Posts: 50,609

Thanks: 28,767

Thanked 14,428 Times in 10,234 Posts

|

Re: Russian SANCTIONS & Dirty Money: Rouble Tumbles as Sanctions Bite /SWIFT Cuts Ban

Re: Russian SANCTIONS & Dirty Money: Rouble Tumbles as Sanctions Bite /SWIFT Cuts Ban

Rouble Tumbles as Sanctions Bite

Russian rouble plunges after new sanctions announced - Russia doubles interest rate after rouble slumps

Russian Oligarchs in UK New Laws Tackling ‘Dirty Money’

Economic crime bill will force transparency on property ownership and expand use of unexplained wealth orders

BBC 28 FEB 2022

People stand in line to use an ATM money machine in St Petersburg on Sunday

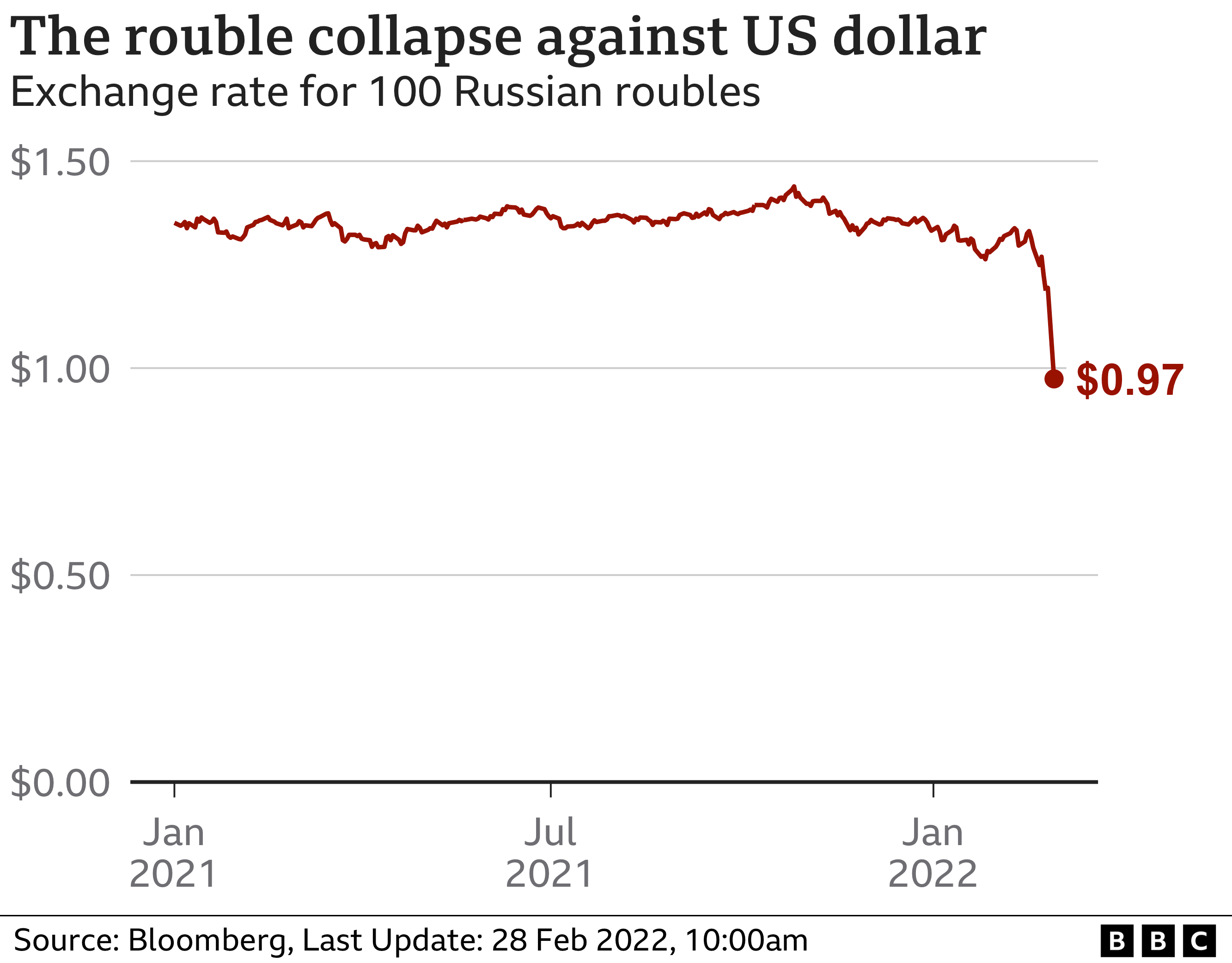

Russia has more than doubled its interest rate to 20% in a bid to halt a slump in the value of its currency.

The Bank of Russia raised the rate from 9.5% after the rouble sank 30% after new Western sanctions. The currency then eased back to stand 20% down.

The collapse in value erodes the currency's buying power and could wipe out the savings of ordinary Russians.

Amid pictures at the weekend of queues at cash machines, Russia said it had the resources to ride out sanctions.

Ahead of an emergency meeting between President Vladimir Putin and his economic advisers on Monday, Kremlin spokesman Dmitry Peskov said: "These are heavy sanctions, they're problematic, but Russia has the necessary potential to compensate the damage from these sanctions." He said Russia would respond with its own sanctions.

At the weekend, Russia's central bank issued an appeal for calm amid fears that new financial sanctions could spark a run on its banks. It said it had the "the necessary resources and tools to maintain financial stability."

Videos on social media appeared to show long queues forming at cash machines and money exchanges in Moscow, with people worried that their bank cards may stop working or that limits will be placed on the amount of cash they can withdraw.

Rouble v Dollar

It came as the UK, along with the US and EU, cut off Russia's banks from financial markets in the West, prohibiting dealings with the central bank, state-owned investment funds and the finance ministry.

Chancellor Rishi Sunak said the measures demonstrated the UK's "determination to apply severe economic sanctions in response to Russia's invasion of Ukraine".

Russia has about $630bn (£470bn) in reserves - a stockpile of savings - built up from soaring oil and gas prices.

But because a lot of this money is stored in foreign currencies like the dollar, the euro and sterling as well as gold, a Western ban on dealing with Russia's central bank restricts Moscow from access to the cash.

Last week, Russia's central bank was forced to increase the amount of money it supplies to ATMs after demand for cash reached the highest level since March 2020.

On Monday, the central bank said it had ordered brokers to suspend the execution of all orders by foreign legal entities and individuals to sell Russian investments.

It also said it had yet to decide whether to open markets other than foreign exchange and money markets on Monday.

Analysis by Theo Leggett, Business Correspondent...

The sanctions that have been imposed by the EU, the US, the UK and others are unprecedented. It's one thing to block the foreign reserves of a country like Iran or Venezuela, quite another to act against Russia - a country with a major role in global trade and a very significant supplier of oil and gas.

The reaction on the currency markets has been dramatic - with the rouble plummeting, despite the central bank's efforts to prop it up using interest rates. There may already have been a rush to the foreign currency ATMs in Russian cities, but citizens there have yet to feel the full impact.

At the very least prices will rise dramatically; banking collapses, hyperinflation and a deep recession are all potential consequences.

But sanctions are a two-way street. Cutting the central bank off from its reserves and limiting Russian institutions' access to the Swift network will not only hurt Russia - western institutions also face losses from debts that cannot or will not be repaid, for example. And then there is the risk of countermeasures from Russia - potentially hitting energy exports.

Such sweeping sanctions being imposed in such a unified way is remarkable. It's also a very big gamble.

'Economic Pariah'

Attempts to put a stranglehold around Russia's finances is sending shockwaves across the financial and corporate world, including:

The price of gas for delivery over the next couple of months soared by 24%

European markets fell amid fears over financial stability, with London's FTSE 100 down more than 1% and Paris and Frankfurt about 2% lower

The price of crude oil jumped 5.4% to $103 per barrel, and the dollar and gold rose as investors sought safer places to put their money

BP's share price slumped by 7% after it decided to exit Russian oil and gas operations at a cost of up to $25bn

Equinor, the energy firm majority owned by the Norway government, starts to divesting its joint ventures in Russia

Wheat prices see their biggest one-day gain in a decade on supply worries from Russia and Ukraine

Russia's stock market remains closed amid fears of a massive share sell-off

Will Walker-Arnott, senior investment manager at Charles Stanley, told the BBC's Today programme that "it looks like Russia is increasingly becoming an economic pariah, increasingly isolated from the global financial system".

Cutting some Russian banks from international payments system Swift is the harshest measure so far imposed to date on Moscow over the Ukraine conflict.

The assets of Russia's central bank will also be frozen, limiting the country's ability to access its overseas reserves.

Russia is heavily reliant on the Swift system for its key oil and gas exports.

The intention is to "further isolate Russia from the international financial system", a joint statement said.

On Monday, the European Central Bank (ECB) said several European subsidiaries of Sberbank Russia, which is Russia's largest bank and majority owned by the Russian government, were failing or likely to fail due to reputational cost of the war in Ukraine.

Sberbank Europe AG, which had total assets of €13.64bn (£11.4bn) at the end of last year, along with its Croatian and Slovenian units, suffered a rapid deposit outflow in recent days and is likely to fail to pay its debts or other liabilities, said the ECB, which is the lenders' supervisor.

Russian Oligarchs in UK New Laws Tackling ‘Dirty Money’.....

Economic crime bill will force transparency on property ownership and expand use of unexplained wealth orders.....

UK fast-tracks law to tackle Russian 'dirty money'

BP to offload stake in Rosneft amid Ukraine conflict

BBC 28 FEB 2022.

The aim is to stop overseas criminals from using agents to create companies or buy property for them in the UK

The UK is fast-tracking legislation to target money-laundering by foreign oligarchs.

The government's move follows Russia's decision to invade Ukraine.

As part of the measures, foreign property owners will have to declare their identities rather than using companies as a façade.

It follows the economic sanctions announced by Prime Minister Boris Johnson on Tuesday which targeted major Russian banks and leaders.

Mr Johnson said that there is "no place for dirty money" in the UK.

"We are going faster and harder to tear back the façade that those supporting Putin's campaign of destruction have been hiding behind for so long."

UK sanctions target Russian banks and oligarchs

"Those backing Putin have been put on notice: there will be nowhere to hide your ill-gotten gains," Mr Johnson added.

The government said the legislation will support the National Crime Agency work in targeting corruption.

The Economic Crime Bill will include a new register that will mean foreign owners of UK property must declare and verify their identities with Companies House.

The aim is to stop overseas criminals and oligarchs from using agents to create companies or buy property for them in the UK.

Entities that refuse to declare their owners will face restrictions in selling property and those who break the rule could be imprisoned for up to five years.

The register also applies to property bought by overseas owners up to 20 years ago in England and Wales and from December 2014 for property in Scotland.

Companies House will also have more information on firms to increase corporate transparency, the government said.

The National Crime Agency's 'Kleptocracy' cell, announced last week, will also begin to investigate sanctions evasion and be able to seize crypto-assets used for money-laundering.

'Time is UP for Putin's Cronies'

The legislation also strengthens Unexplained Wealth Orders (UWOs) which were powers brought into force in January 2018 in the fight against suspected criminal money invested in property.

However, UWOs have been used just four times since 2018 and only one has resulted in property being surrendered so far.

UWOs will be reformed to give law enforcement agencies more time to review case material and to protect them from substantial legal costs if they pursue reasonable cases which are ultimately unsuccessful.

Home Secretary Priti Patel said: "Time is up for Putin's cronies hiding dirty money in the UK and this new legislation will help to crack down on economic crime, including removing key barriers to using Unexplained Wealth Orders."

Shadow chancellor Rachel Reeves said that Labour supports the legislation and will "scrutinise the strength of these measures, which the government must enact in their strongest form to tackle dirty money once and for all."

1000 and 500 ruble banknotes

Labour said the measures were "welcome" but "don't yet go far and fast enough"

"The long overdue Register of Overseas Entities, originally promised in 2016, must now be implemented at speed. Any transition period must be completed by the end of March and be accompanied by tough enforcement measures," she continued.

Business Secretary Kwasi Kwarteng said the new register will "shine a light" on who owns what in the UK so the government could "flush out the oligarchs, criminals and kleptocrats who think they can use UK property to hide their illicitly obtained wealth."

Shadow home secretary Yvette Cooper said the measures were "welcome" but "don't yet go far and fast enough".

"Alongside strong sanctions we need an urgent crackdown on illicit finance, corruption and organised crime linked to Russia. For too long the City of London and the UK economy has been used as a laundromat by corrupt elites linked to organised crime," Ms Cooper added.

The anti-corruption organisation Transparency International has identified at least £1.5bn of UK property owned by Russians accused of financial crime or with links to the Kremlin.

As part of the latest round of sanctions, Mr Johnson said the government will also limit the amount of money Russian nationals will be able to deposit in their UK bank account.

How much Russian money is there in the UK?

Suitcase full of roubles

__________________

AMERICA WAS ONCE AN INNOVATED & RESPECTED COUNTRY and THEN ALONG CAME TRUMP.....

That buzz you hear is George Washington spinning in his grave

That buzz you hear is George Washington spinning in his grave

|